Resource rich countries often fail to secure a fair share of their natural resource wealth. Sometimes this is the result of weak national legislation and poorly negotiated contracts. Frequently it is the result of company strategies to minimize tax payments.

A list of national-level benefits from the extractive industries includes economic growth, employment, infrastructure, corporate social investment and taxes. Of these five, taxes are the most significant. According to the Chair of Tullow Oil, “the biggest single contribution by far that we make is the tax that we pay. And it dwarfs the others.”

Supreme Audit Institutions (SAIs) have an essential role to play in ensuring that governments get a reasonable share of EI revenues through taxes and other fiscal instruments such as royalties and production sharing.

The WGEI has oriented its work around the EI value chain. The 5th step in the chain is the “Collection of Revenues.” However, the objective is not simply to collect revenues but to maximize those revenues. Securing a reasonable share requires establishing appropriate fiscal terms in the legal framework, negotiating good contracts with resource companies, and monitoring project revenues and project costs.

Governments receive less revenue than they should because relevant ministries and regulatory bodies lack capacity. Companies also exploit weakness in government oversight due either to regulatory gaps and poor coordination. SAIs can help to overcome these weaknesses by adopting a holistic approach to auditing cross-governmental revenue generation efforts.

Resources for Development Consulting assists resource-rich countries to secure a fair share of the revenue generated from mineral and petroleum projects. We developed a risk assessment methodology to help governments identify pathways to revenue loss. An overview, along with an extensive collection of “real-world” case studies, is published in Many Ways to Lose a Billion (PWYP-Canada, 2017). The report is available in English, French and Spanish.

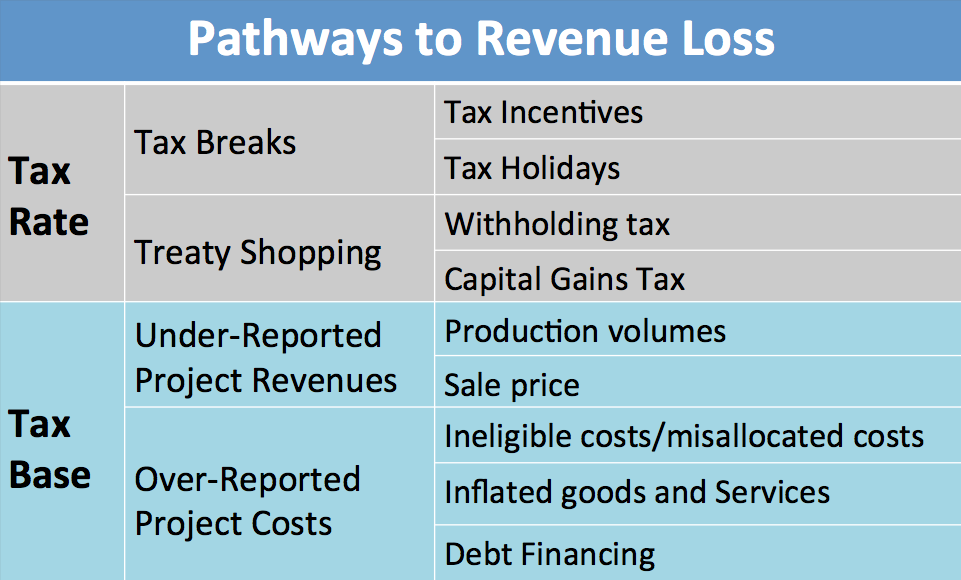

The framework starts with the basic distinction between setting the tax rates that apply to a project, and protecting the tax base (the revenues) against which those taxes will be applied.

Most developing countries set out the fiscal terms that will apply to EI projects in a contract. Governments often offer significant tax breaks during contract negotiations without fully understanding their revenue implications. Sometimes these are part of the headlines terms, such as corporate tax holidays, but often they are buried in the fine print, such as the deductions allowed for the calculation of taxable income.

Once the terms of the contract have been agreed, companies often seek to improve those terms by engaging in “treaty shopping,” taking advantage of the network of Double Taxation Treaties. By creating subsidiaries in third countries, companies secure reductions, and in some cases complete exemptions, in capital gains and withholding taxes.

The package of fiscal terms establishes the revenues the government should receive in “theory.” Governments often find that actual receipts fall far short of expectations. This can be the result of a slump in commodity prices, but it is often the result of company strategies to erode the tax base.

In some cases, the company under-reports projects revenue, thereby reducing payments to government on both production and profits. This can be done by under-reporting the quantity and quality of the commodity, and by selling the commodity to an affiliated company at below fair-market value.

In other cases, the company over-reports project costs, thereby reducing profit-based taxes. This can be done by claiming ineligible or misallocated costs and by inflating the costs of goods and services provided by an affiliated company.

Unfortunately, there are many pathways to government revenue loss. But they are not unlimited. There are clear patterns repeated over-and-over, country-by-country. SAIs can contribute to revenue protection by applying a comprehensive revenue risk assessment to their national context. The assessment should be adapted based on four Cs: the country legislation, the specific commodity, the company and its structure of subsidiaries and affiliates, and potential loopholes in the contract.

In most countries, there is a profound imbalance in expertise between the lawyers and accountants representing companies and the officials representing their country. The case studies in Many Ways to Lose a Billion reveal that developed countries with strong tax administration also struggle to collect a fair share of revenues. The issues that need to be addressed are technical and, in some cases, very complex. SAIs need a high level of expertise in order to protect their country’s revenue interests.

By Don Hubert

Bio: Don Hubert is the founder and President of Resources for Development Consulting (www.res4dev.com), a policy research firm that seeks to assist citizens in resource-rich developing countries in securing a fair share of natural resource wealth. His work focuses on analyzing EI contracts and fiscal regimes, modeling plausible past and potential government revenues, assessing vulnerability to company tax avoidance and identifying risks of corruption. He has conducted economic analyses of extractive sector projects in Belize, Cambodia, Chad, Kenya, Malawi, Mozambique, Tanzania, Uganda and Zimbabwe. He was previously a Canadian diplomat and university professor. He holds a PhD from the University of Cambridge, UK.